Financial Services Expertise

Changing the economics of Financial Services through better service to customers

Typically, our clients in Financial Services will:

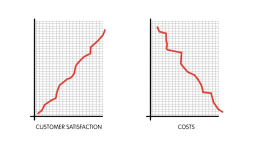

- increase NPS from negative or neutral to >90%

- increase GI sales to over 160% of target

- reduce indemnity spend

- change the fundamental economics of claims handling

- gain over 80% capacity in Life servicing

- decrease the time to open and fund new bank accounts from an average of 51 days to the same day

- gain over 35% capacity in global banking servicing

- insource work without adding headcount

- eliminate the need for IVR systems

- reduce levels of failure demand down to single digits

- reduce backlogs of work to no backlogs at all and same day processing

- design in changes to meet regulation in months, not years

- no longer fire-fight complaints, instead understand the causes of complaints, therefore eliminating the vast majority before they occur

- increase the number of employees that contribute into their Super fund, are on more panels, and win more tenders

- see significant improvement in their positive net flow Super fund rollover position

- receive a return of 1:8 on their spend with Vanguard

Better for customers, for example:

- Insurance claims settlements from an average of 84 down to 6 days

- Bank account opening and funding from an average of 35 days down to 38 minutes

- Bond encashments from an average of 60 days to on demand (there and then)

- Approval of mortgage applications from an average of 7 days to same day

- First point resolution from 60% to 90%

From Superannuation to credit cards, bank loans to household claims, account opening to payments, the Vanguard Method is achieving amazing results for our financial services clients.

All have achieved improvements in customer satisfaction, it’s been better for the people that serve customers and the shareholders have seen the benefits of improved profits.

The Vanguard Method is fast becoming the standard design in the Life and General Insurance sector. It is already been used to transform service, performance, and reduce indemnity spend in Aviva and Lloyds Banking Group. Don’t take our word for it, hear from leaders who have crossed the rubicon.